Understanding Equity Loans Interest Rates: How to Secure the Best Deals

Guide or Summary:Equity Loans Interest RatesFactors Influencing Equity Loans Interest RatesComparing Equity Loans Interest RatesStrategies for Securing Lowe……

Guide or Summary:

- Equity Loans Interest Rates

- Factors Influencing Equity Loans Interest Rates

- Comparing Equity Loans Interest Rates

- Strategies for Securing Lower Equity Loans Interest Rates

Equity Loans Interest Rates

Equity loans interest rates are a crucial factor for homeowners considering tapping into their home equity. Home equity loans allow you to borrow against the value of your home, providing you with funds for various needs, such as home renovations, debt consolidation, or even funding education. However, the interest rates associated with these loans can significantly impact your financial situation.

When you take out a home equity loan, you are essentially securing a second mortgage on your property. The amount you can borrow is typically based on the equity you have built up in your home, which is the difference between the current market value of your home and the remaining balance on your primary mortgage. As home values rise, so does your potential borrowing capacity. However, the interest rates on equity loans can vary widely based on several factors, including your credit score, the amount of equity you have, and overall market conditions.

Factors Influencing Equity Loans Interest Rates

Several factors can influence the interest rates for equity loans. One of the most significant is your credit score. Lenders assess your creditworthiness to determine the risk associated with lending to you. A higher credit score typically results in lower interest rates, as it indicates a lower risk of default. Conversely, a lower credit score may lead to higher rates, as lenders may view you as a higher risk.

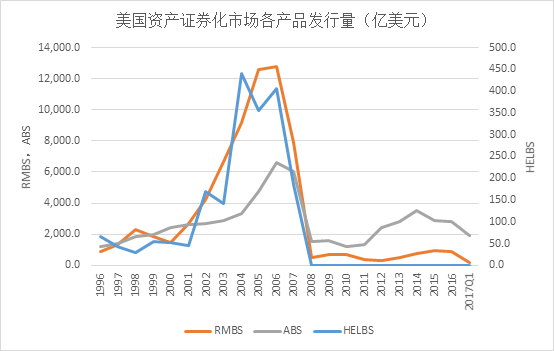

Another factor is the amount of equity you have in your home. Generally, the more equity you can demonstrate, the more favorable your interest rates will be. Lenders prefer to lend to borrowers who have a substantial amount of equity, as it provides a cushion in case of default. Additionally, the overall economic environment plays a role. When interest rates are low, lenders are more likely to offer competitive rates for equity loans. Conversely, in a rising interest rate environment, you may find that equity loans come with higher rates.

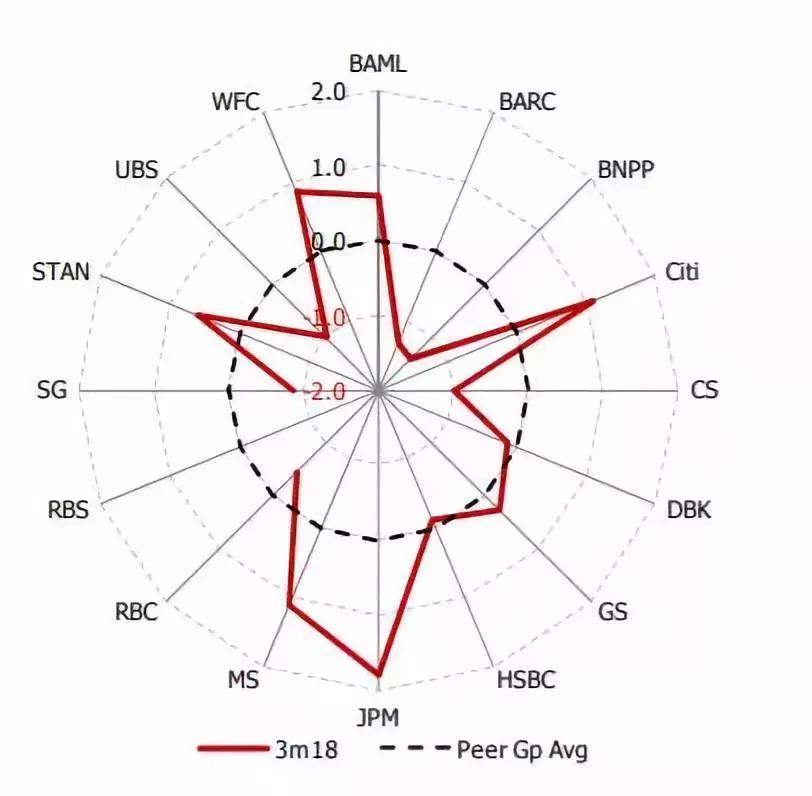

Comparing Equity Loans Interest Rates

To secure the best equity loans interest rates, it’s essential to shop around and compare offers from different lenders. Each lender may have unique criteria for determining rates, and some may offer promotional rates or discounts for existing customers. Online comparison tools can be invaluable in this process, allowing you to see a range of options quickly.

When comparing rates, don’t forget to consider additional fees and costs associated with the loan. Some lenders may have lower interest rates but charge higher origination fees or closing costs, which can negate any savings you might gain from a lower rate. Always read the fine print and calculate the total cost of the loan over its term to make an informed decision.

Strategies for Securing Lower Equity Loans Interest Rates

If you’re looking to secure lower equity loans interest rates, consider the following strategies:

1. **Improve Your Credit Score**: Before applying for a loan, take steps to improve your credit score. Pay down existing debts, make timely payments, and avoid taking on new debt.

2. **Increase Your Home Equity**: If possible, pay down your primary mortgage to increase your equity. This can help you qualify for better rates.

3. **Consider Fixed vs. Variable Rates**: Equity loans can come with either fixed or variable interest rates. A fixed rate provides stability, while a variable rate may start lower but can increase over time. Consider your financial situation and risk tolerance when making this decision.

4. **Negotiate with Lenders**: Don’t hesitate to negotiate with lenders. If you have received better offers from competitors, use them as leverage to negotiate better terms.

In conclusion, understanding equity loans interest rates is essential for homeowners looking to leverage their home equity. By considering the factors that influence these rates, comparing offers, and employing strategies to secure lower rates, you can make informed decisions that align with your financial goals. Always remember to read the fine print and assess the total cost of borrowing before committing to any loan.