Understanding PHEAA Loan Options: A Comprehensive Guide to Student Financial Aid

#### Description:The **PHEAA Loan** is an essential component of the financial aid landscape for students pursuing higher education in the United States. Th……

#### Description:

The **PHEAA Loan** is an essential component of the financial aid landscape for students pursuing higher education in the United States. The Pennsylvania Higher Education Assistance Agency (PHEAA) offers various loan programs designed to help students manage the costs of college. In this guide, we will explore the different types of **PHEAA Loans**, their features, eligibility criteria, and repayment options to help you make informed decisions about financing your education.

#### What is a PHEAA Loan?

The **PHEAA Loan** is a student loan program administered by the Pennsylvania Higher Education Assistance Agency. It aims to provide financial assistance to students who are residents of Pennsylvania or attending eligible institutions within the state. These loans are designed to supplement other forms of financial aid such as grants, scholarships, and federal loans, ensuring that students can cover their educational expenses.

#### Types of PHEAA Loans

There are several types of **PHEAA Loans** available, each catering to different needs:

1. **PHEAA State Grant Program**: While not a loan, this grant program provides need-based financial assistance to eligible Pennsylvania residents attending college. It is important to apply early, as funds are limited.

2. **PHEAA Alternative Loans**: These loans are designed for students who may not qualify for federal loans or need additional funding. The terms and interest rates can vary based on the borrower’s creditworthiness.

3. **PHEAA Consolidation Loans**: For borrowers with multiple student loans, consolidation loans can simplify repayment by combining several loans into one, often with a lower interest rate.

#### Eligibility Criteria

To qualify for a **PHEAA Loan**, students generally need to meet the following criteria:

- Be a resident of Pennsylvania or attend an eligible institution within the state.

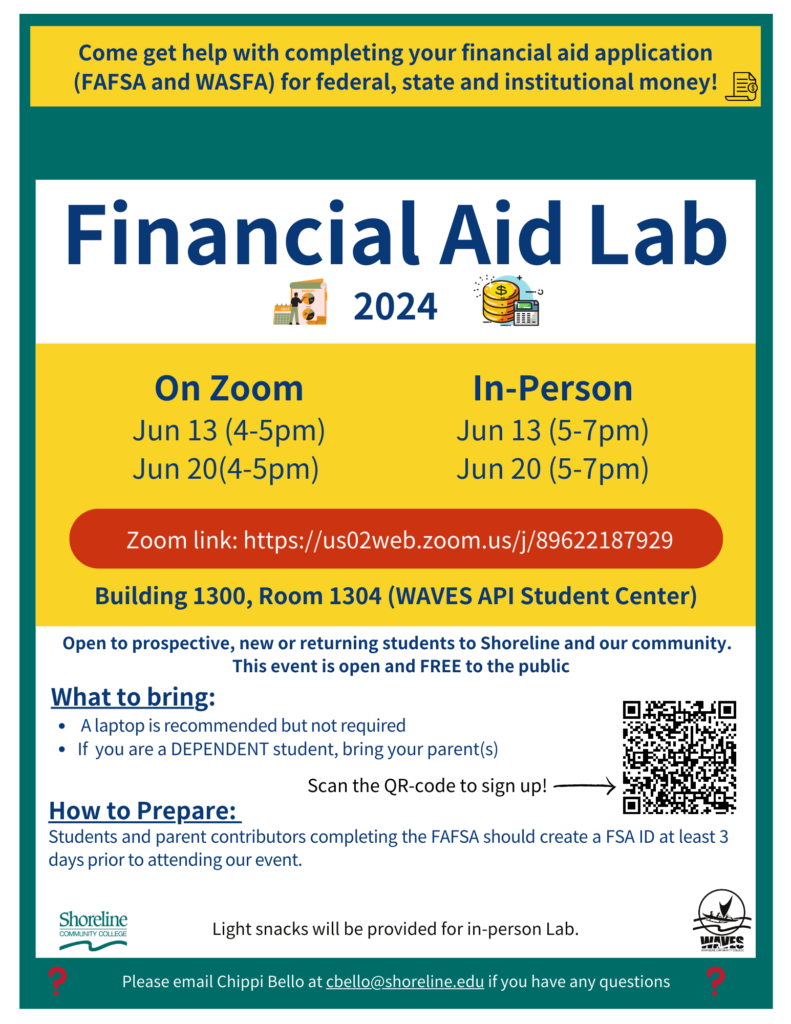

- Complete the Free Application for Federal Student Aid (FAFSA) to determine financial need.

- Maintain satisfactory academic progress in their chosen program of study.

#### Application Process

Applying for a **PHEAA Loan** involves several steps:

1. **Complete the FAFSA**: This is the first step in determining your eligibility for federal and state financial aid.

2. **Review Your Financial Aid Package**: After submitting the FAFSA, you will receive a financial aid package from your college, which may include PHEAA loan options.

3. **Accept Your Loan**: If you decide to accept a PHEAA loan, you will need to complete any necessary paperwork provided by your school.

4. **Loan Disbursement**: Once approved, the funds will be disbursed to your school to cover tuition and other educational expenses.

#### Repayment Options

Understanding the repayment options for your **PHEAA Loan** is crucial for managing your finances after graduation. Here are some key points:

- **Grace Period**: Most PHEAA loans come with a grace period, allowing borrowers a set amount of time after graduation before they must start repaying their loans.

- **Repayment Plans**: Borrowers can choose from various repayment plans, including standard, graduated, and income-driven repayment options.

- **Loan Forgiveness**: Certain borrowers may qualify for loan forgiveness programs, especially those working in public service or specific professions.

#### Conclusion

Navigating the world of student loans can be daunting, but understanding your options, especially when it comes to **PHEAA Loans**, can significantly ease the burden of financing your education. By familiarizing yourself with the types of loans available, eligibility requirements, application processes, and repayment options, you can make informed decisions that align with your financial goals. Always consider reaching out to a financial aid advisor for personalized guidance tailored to your unique situation.