Unlock Your Financial Freedom with a $10,000 Personal Loan for Those with a 600 Credit Score

Guide or Summary:Understanding Personal LoansThe Challenge of a 600 Credit ScoreHow to Secure a $10,000 Personal Loan with a 600 Credit ScoreThe Benefits of……

Guide or Summary:

- Understanding Personal Loans

- The Challenge of a 600 Credit Score

- How to Secure a $10,000 Personal Loan with a 600 Credit Score

- The Benefits of a $10,000 Personal Loan

Are you feeling overwhelmed by unexpected expenses or financial burdens? If you have a credit score of 600, you might think that obtaining a personal loan is out of reach. However, there are options available for individuals like you seeking a $10,000 personal loan. In this article, we will explore how you can secure a loan despite your credit score and the benefits it can bring to your financial situation.

Understanding Personal Loans

A personal loan is a type of unsecured loan that allows you to borrow money for various purposes, such as consolidating debt, funding a large purchase, or covering emergency expenses. Unlike traditional loans that may require collateral, personal loans rely primarily on your creditworthiness. This makes them an attractive option for many borrowers.

The Challenge of a 600 Credit Score

A credit score of 600 is considered fair, which may limit your borrowing options. Lenders often view this score as a risk factor, which can lead to higher interest rates or even denial of your loan application. However, it’s essential to understand that not all lenders have the same criteria, and some specialize in providing loans to individuals with lower credit scores.

How to Secure a $10,000 Personal Loan with a 600 Credit Score

1. **Research Lenders**: Start by researching lenders that cater to individuals with fair credit scores. Many online lenders, credit unions, and peer-to-peer lending platforms are more flexible with their borrowing criteria.

2. **Check Your Credit Report**: Before applying, review your credit report for any inaccuracies that may be dragging down your score. Dispute any errors you find, as correcting them can potentially improve your score.

3. **Consider a Co-Signer**: If you have a trusted friend or family member with a better credit score, consider asking them to co-sign your loan. This can increase your chances of approval and may result in better loan terms.

4. **Provide Documentation**: Prepare to provide documentation that demonstrates your ability to repay the loan, such as proof of income, employment history, and any existing debts. A strong financial profile can help offset a lower credit score.

5. **Be Prepared for Higher Interest Rates**: Keep in mind that loans for those with a 600 credit score may come with higher interest rates. Make sure to calculate the total cost of the loan and ensure it fits within your budget.

The Benefits of a $10,000 Personal Loan

Securing a $10,000 personal loan can provide numerous benefits, especially if you are facing financial challenges. Here are some advantages:

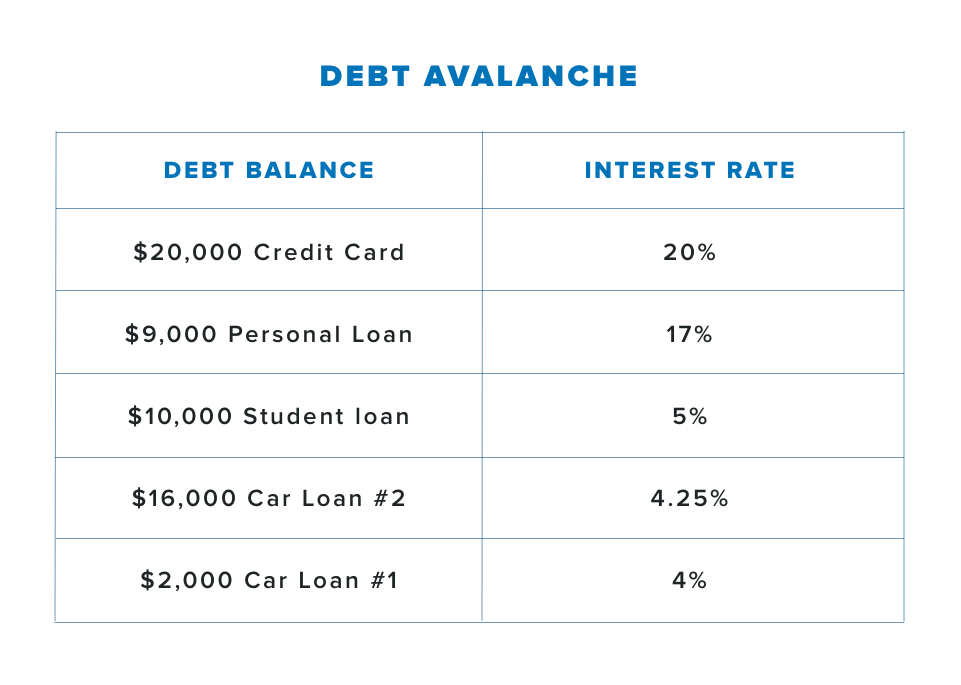

- **Debt Consolidation**: If you have multiple high-interest debts, a personal loan can help you consolidate them into a single, lower-interest payment, making it easier to manage your finances.

- **Emergency Expenses**: Life can be unpredictable, and a personal loan can provide the necessary funds to cover unexpected medical bills, car repairs, or other urgent expenses.

- **Improving Credit Score**: By responsibly managing your personal loan payments, you can improve your credit score over time. This can open doors to better loan options in the future.

- **Flexibility**: Personal loans can be used for a variety of purposes, giving you the flexibility to address your specific financial needs.

Obtaining a $10,000 personal loan with a 600 credit score may seem challenging, but it is entirely possible with the right approach. By researching your options, preparing your documentation, and understanding the benefits of personal loans, you can take control of your financial situation. Don’t let a lower credit score hold you back from achieving your financial goals—explore your options today and unlock the financial freedom you deserve!