Discover Your Dream Home Financing with the www Mortgage Loan Calculator

Guide or Summary:Understanding the Importance of a Mortgage Loan CalculatorHow to Use the www Mortgage Loan Calculator EffectivelyBenefits of Using a Mortga……

Guide or Summary:

- Understanding the Importance of a Mortgage Loan Calculator

- How to Use the www Mortgage Loan Calculator Effectively

- Benefits of Using a Mortgage Loan Calculator

- Common Mistakes to Avoid When Using a Mortgage Loan Calculator

- Conclusion: Take Control of Your Home Financing Journey

Understanding the Importance of a Mortgage Loan Calculator

In today's fast-paced real estate market, knowing how much you can afford for a home is crucial. This is where the **www mortgage loan calculator** comes into play. A mortgage loan calculator is a powerful tool that helps potential homebuyers estimate their monthly mortgage payments based on various factors, including loan amount, interest rate, and loan term. By using this calculator, buyers can make informed decisions about their home financing options, ensuring they stay within their budget while still finding their dream home.

How to Use the www Mortgage Loan Calculator Effectively

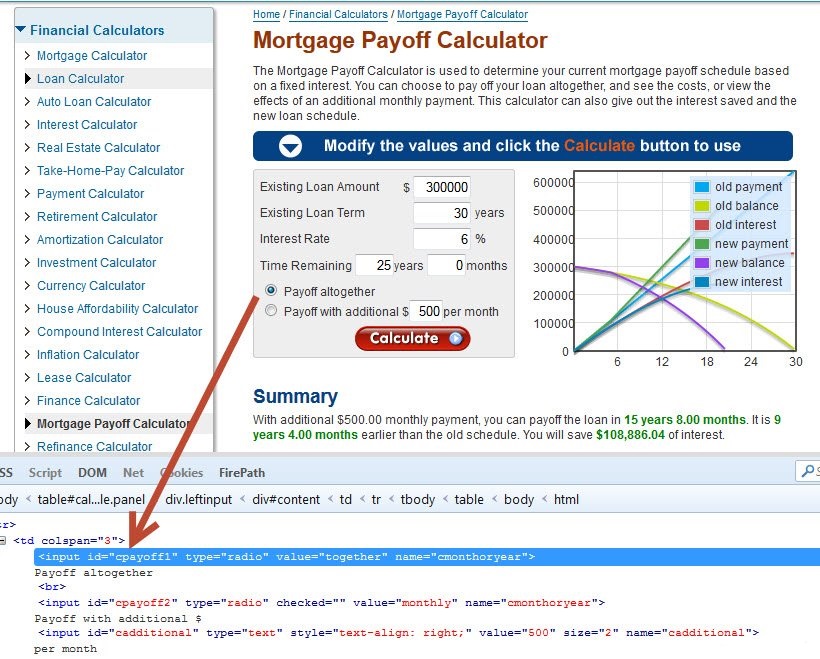

Using the **www mortgage loan calculator** is straightforward. First, you input the total amount of the loan you wish to take out. This is typically the purchase price of the home minus any down payment you can afford. Next, you will enter the interest rate, which can vary based on your credit score and current market conditions. Finally, you will need to specify the loan term, which is usually 15 or 30 years. Once you have filled in these details, the calculator will provide you with an estimated monthly payment, allowing you to gauge whether the home fits within your financial plan.

Benefits of Using a Mortgage Loan Calculator

The benefits of utilizing the **www mortgage loan calculator** are numerous. Firstly, it empowers you with knowledge. By understanding your potential monthly payments, you can adjust your home search according to your budget. Additionally, it can help you compare different loan scenarios. For instance, if you're unsure whether to opt for a 15-year or 30-year mortgage, the calculator can show you how the monthly payments differ, helping you make a more informed decision.

Moreover, the calculator can give insights into the total cost of the loan over its lifetime. This includes interest paid, which can significantly impact your overall financial health. By visualizing these costs, you can better understand the long-term implications of your mortgage choice.

Common Mistakes to Avoid When Using a Mortgage Loan Calculator

While the **www mortgage loan calculator** is a valuable tool, it's essential to use it correctly to avoid common pitfalls. One mistake is failing to account for additional costs associated with homeownership, such as property taxes, homeowners insurance, and maintenance costs. These expenses can add up quickly and should be factored into your budget.

Another mistake is not considering the impact of interest rate fluctuations. If you're using a fixed-rate mortgage, your interest rate will remain the same throughout the loan term. However, if you're considering an adjustable-rate mortgage, it's vital to understand how your payments may change over time.

Conclusion: Take Control of Your Home Financing Journey

In conclusion, the **www mortgage loan calculator** is an indispensable resource for anyone looking to purchase a home. By providing a clear picture of your potential mortgage payments and the total cost of your loan, this tool can help you make educated decisions throughout your home-buying journey. Remember to use it wisely, considering all associated costs and potential interest rate changes, to ensure you find a mortgage that fits your financial situation. Start exploring your options today and take the first step towards owning your dream home!