Unlock Quick Cash with Fast Title Loan: Your Ultimate Guide to Getting Funded Instantly

#### Fast Title LoanIn today’s fast-paced world, financial emergencies can arise at any moment. Whether it's unexpected medical bills, urgent home repairs……

#### Fast Title Loan

In today’s fast-paced world, financial emergencies can arise at any moment. Whether it's unexpected medical bills, urgent home repairs, or any other pressing need for cash, having quick access to funds is crucial. This is where a fast title loan comes into play. A fast title loan allows borrowers to leverage the equity in their vehicles to secure immediate cash, often with minimal paperwork and quick approval times.

#### What is a Fast Title Loan?

A fast title loan is a type of secured loan where the borrower uses their vehicle's title as collateral. Unlike traditional loans that require extensive credit checks and lengthy approval processes, fast title loans are designed for speed and convenience. Typically, the loan amount is based on the vehicle's value, and borrowers can receive cash in hand within a few hours or even minutes, depending on the lender.

#### How Does a Fast Title Loan Work?

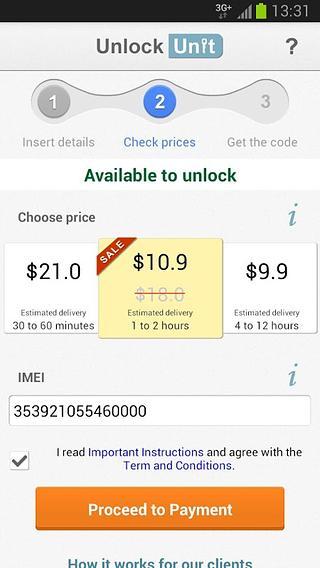

The process of obtaining a fast title loan is straightforward:

1. **Application**: You start by filling out an application, which can often be done online. You'll need to provide details about your vehicle, including its make, model, year, and condition.

2. **Vehicle Valuation**: The lender will assess the value of your vehicle to determine how much you can borrow. This often involves a quick inspection or appraisal.

3. **Documentation**: You'll need to provide the vehicle title, proof of income, and identification. Some lenders may also require proof of insurance.

4. **Approval**: Once your application is reviewed, and your vehicle is appraised, you can receive approval almost instantly.

5. **Cash Disbursement**: After approval, the funds are typically disbursed quickly, allowing you to address your financial needs without delay.

#### Benefits of Fast Title Loans

There are several advantages to choosing a fast title loan:

- **Quick Access to Cash**: One of the main attractions of a fast title loan is the speed at which you can receive funds. This is ideal for urgent financial situations.

- **Minimal Credit Checks**: Many lenders do not perform extensive credit checks, making it easier for those with poor credit histories to obtain loans.

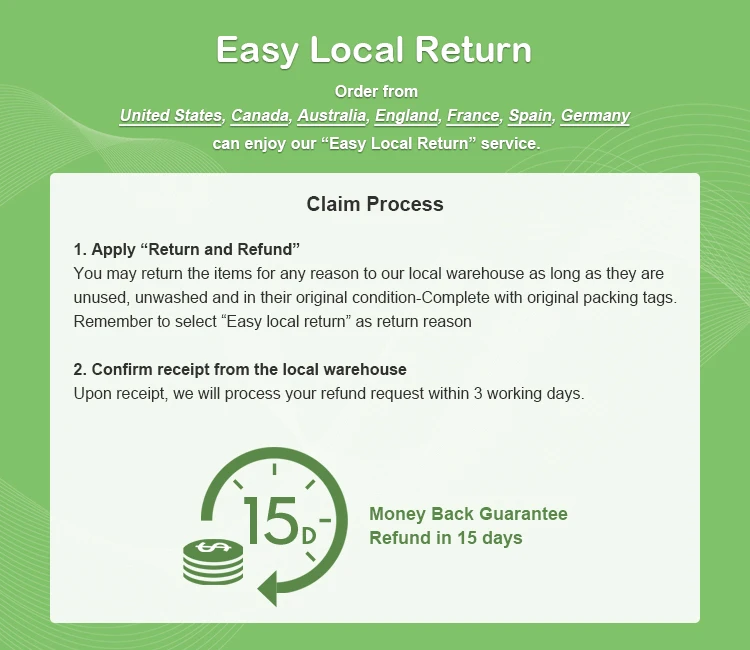

- **Flexible Repayment Terms**: Most lenders offer flexible repayment options, allowing borrowers to choose a plan that fits their financial situation.

- **Keep Your Vehicle**: Unlike some other types of loans, you can continue to use your vehicle while repaying the loan, making it a convenient option for those who rely on their cars for daily transportation.

#### Considerations Before Getting a Fast Title Loan

While fast title loans can be beneficial, it’s essential to consider a few factors before committing:

- **Interest Rates**: Fast title loans can come with high-interest rates. Make sure to read the terms and understand the total cost of borrowing.

- **Risk of Repossession**: If you default on the loan, the lender has the right to repossess your vehicle. Ensure you are confident in your ability to repay the loan before proceeding.

- **State Regulations**: Title loan regulations vary by state. Familiarize yourself with your state’s laws to ensure you are making an informed decision.

#### Conclusion

In summary, a fast title loan can be a viable solution for those in need of quick cash. With a simple application process, minimal credit checks, and rapid funding, these loans can help you navigate financial emergencies effectively. However, it is crucial to weigh the benefits against the potential risks and costs involved. As with any financial decision, doing thorough research and understanding your options will lead to a more informed and satisfactory outcome.