How to Become a Loan Broker: A Comprehensive Guide to Starting Your Career in the Financial Industry

#### Introduction to Becoming a Loan BrokerBecoming a loan broker is an exciting opportunity for individuals looking to enter the financial industry. Loan b……

#### Introduction to Becoming a Loan Broker

Becoming a loan broker is an exciting opportunity for individuals looking to enter the financial industry. Loan brokers play a crucial role in connecting borrowers with lenders, helping clients secure financing for various needs, from personal loans to mortgages. This guide will walk you through the essential steps and considerations for starting your career as a loan broker.

#### Understanding the Role of a Loan Broker

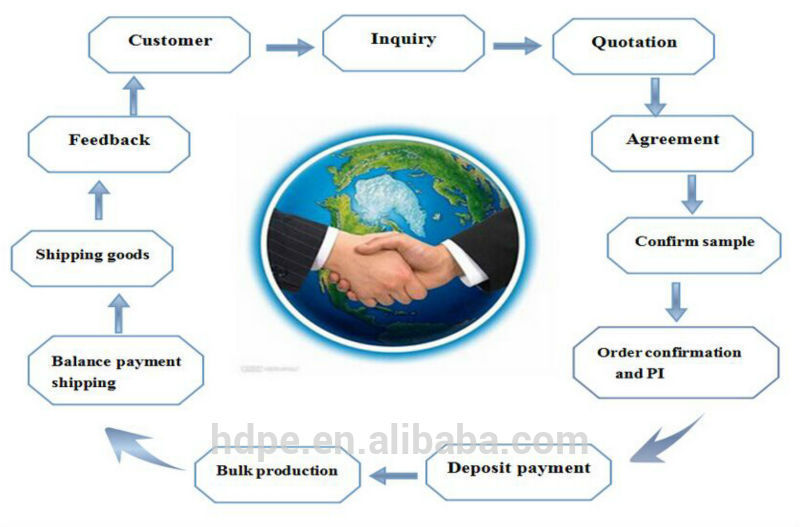

A loan broker acts as an intermediary between borrowers and lenders. They assess the financial needs of clients, provide advice on suitable loan products, and help navigate the application process. Loan brokers must possess strong communication skills, financial knowledge, and an understanding of the lending landscape. By becoming a loan broker, you can offer valuable services to clients while also enjoying the potential for a lucrative income.

#### Steps to Become a Loan Broker

1. **Research the Industry**: Before diving in, it’s essential to understand the loan brokerage industry. Familiarize yourself with different types of loans, lending institutions, and the regulatory environment governing loan brokers. This knowledge will be invaluable as you begin your career.

2. **Obtain Necessary Education**: While formal education is not always required, having a background in finance, business, or economics can be beneficial. Some loan brokers choose to pursue certifications or courses related to mortgage brokerage or financial services to enhance their credibility.

3. **Gain Experience**: Experience in the financial sector can provide a solid foundation for your career. Consider working in a related field, such as banking or financial advising, to gain insights and skills that will help you as a loan broker.

4. **Get Licensed**: In many regions, loan brokers must obtain a license to operate legally. Research the licensing requirements in your area, which may include completing specific coursework, passing an exam, and submitting to a background check.

5. **Build a Network**: Networking is crucial in the loan brokerage business. Establish relationships with lenders, real estate agents, and other professionals in the industry. A strong network can lead to referrals and help you build a successful business.

6. **Develop Marketing Strategies**: As a loan broker, you’ll need to attract clients. Develop a marketing plan that includes online presence, social media engagement, and local advertising. Highlight your expertise and the benefits of working with you to secure loans.

7. **Stay Informed**: The financial industry is constantly evolving, with new regulations and loan products emerging regularly. Stay updated on industry trends, changes in lending practices, and economic factors that may affect borrowing.

#### Benefits of Becoming a Loan Broker

- **Flexibility**: Many loan brokers enjoy the flexibility of working independently or setting their schedules. This can lead to a better work-life balance.

- **Earning Potential**: Loan brokers often earn commissions based on the loans they facilitate, which can lead to significant income potential, especially as you build your client base.

- **Helping Others**: As a loan broker, you play a vital role in helping individuals and businesses secure the financing they need to achieve their goals.

#### Conclusion

Becoming a loan broker can be a rewarding career choice for those passionate about finance and helping others. By following the steps outlined in this guide, you can establish yourself in this dynamic industry. With dedication, knowledge, and a commitment to client service, you can succeed as a loan broker and make a positive impact in the lives of your clients.