Understanding Recourse Loans: Benefits, Risks, and Key Considerations

#### What is a Recourse Loan?A recourse loan is a type of loan in which the borrower is personally liable for the debt. In the event of default, the lender……

#### What is a Recourse Loan?

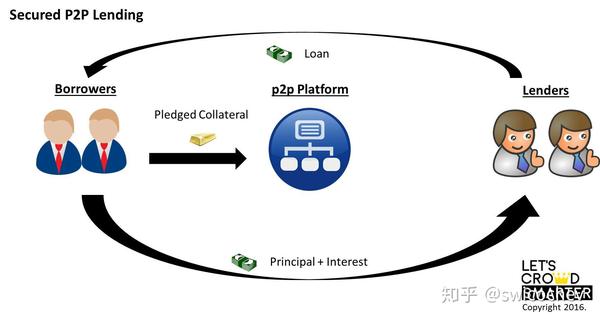

A recourse loan is a type of loan in which the borrower is personally liable for the debt. In the event of default, the lender has the right to pursue the borrower's other assets beyond the collateral pledged for the loan. This means that if the borrower fails to repay the loan, the lender can go after their personal assets, such as bank accounts, investments, or even wages, to recover the outstanding amount.

#### Benefits of Recourse Loans

One of the main advantages of recourse loans is that they typically come with lower interest rates compared to non-recourse loans. This is because lenders perceive recourse loans as less risky; they have more avenues to recover their funds in case of default. Additionally, borrowers may find it easier to qualify for a recourse loan, as lenders may be more willing to extend credit when they have the right to pursue personal assets.

Another benefit is that recourse loans can provide borrowers with more financing options. Since lenders feel more secure in their investment, they may offer higher loan amounts or extend better terms, making it easier for borrowers to fund significant purchases, such as a home or a business venture.

#### Risks Associated with Recourse Loans

However, recourse loans also come with inherent risks. The most significant risk is the potential for losing personal assets in the event of default. Borrowers must carefully consider their ability to repay the loan and ensure they have a solid financial plan in place. If circumstances change, such as job loss or unexpected expenses, borrowers may find themselves in a precarious situation where they could lose more than just the collateral.

Additionally, the pressure of being personally liable for the debt can lead to stress and anxiety. Borrowers may feel compelled to make sacrifices in their personal or professional lives to meet their loan obligations, which can affect their overall well-being.

#### Key Considerations Before Taking a Recourse Loan

Before deciding to take out a recourse loan, borrowers should assess their financial situation thoroughly. It is crucial to evaluate income stability, current debts, and future financial goals. Consulting with a financial advisor can provide valuable insights and help borrowers make informed decisions.

Another important consideration is the type of collateral being used for the loan. Borrowers should understand the implications of pledging specific assets and consider whether they are comfortable risking those assets in the event of default.

#### Conclusion

In summary, recourse loans can be a useful financial tool for those looking to secure funding while benefiting from lower interest rates and more favorable terms. However, they come with significant risks, particularly concerning personal liability. Borrowers must weigh the benefits against the potential downsides and ensure they have a solid repayment plan in place. By understanding the intricacies of recourse loans, individuals can make better financial decisions that align with their long-term goals.