Unlock Your Business Potential with Business Loans Michigan: Tailored Financing Solutions

Guide or Summary:Understanding Business Loans MichiganTypes of Business Loans AvailableThe Application Process for Business Loans in MichiganChoosing the Ri……

Guide or Summary:

- Understanding Business Loans Michigan

- Types of Business Loans Available

- The Application Process for Business Loans in Michigan

- Choosing the Right Business Loan for You

When it comes to growing your business in the vibrant state of Michigan, securing the right financing can make all the difference. Whether you're looking to expand your operations, invest in new equipment, or manage day-to-day expenses, business loans Michigan offer a variety of options designed to meet your unique needs. In this article, we will explore the different types of business loans available, the application process, and how to choose the best financing solution for your business.

Understanding Business Loans Michigan

Business loans in Michigan come in various forms, each tailored to suit different business requirements. From traditional bank loans to alternative financing options, understanding the landscape of business loans Michigan is crucial for entrepreneurs. Traditional bank loans typically offer lower interest rates but can be challenging to qualify for due to stringent credit requirements. On the other hand, alternative lenders may provide more flexible terms and quicker access to funds, albeit often at higher interest rates.

Types of Business Loans Available

1. **Term Loans**: These are standard loans where you borrow a fixed amount of money and repay it over a set period. They are ideal for businesses looking to make significant investments.

2. **SBA Loans**: Backed by the Small Business Administration, these loans offer favorable terms and lower down payments, making them an attractive option for many Michigan entrepreneurs.

3. **Lines of Credit**: A business line of credit gives you access to a set amount of funds that you can draw from as needed. This flexibility is perfect for managing cash flow fluctuations.

4. **Equipment Financing**: If your business requires new equipment, this type of loan allows you to finance the purchase while using the equipment as collateral.

5. **Invoice Financing**: This option allows businesses to borrow against outstanding invoices, providing quick access to cash without waiting for customers to pay.

The Application Process for Business Loans in Michigan

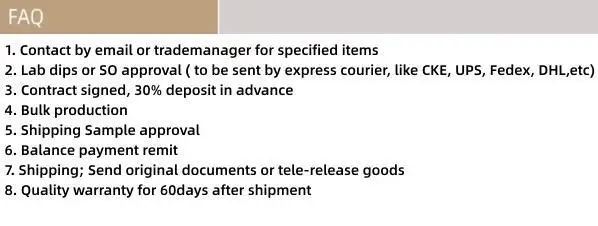

Applying for a business loan in Michigan involves several steps. First, you'll need to gather your financial documents, including tax returns, bank statements, and a detailed business plan. Next, research different lenders to find the best fit for your needs. Each lender may have different requirements, so it's essential to understand what they are looking for.

Once you've selected a lender, you'll submit your application along with the necessary documentation. The lender will review your application, assess your creditworthiness, and determine the loan amount and terms. If approved, you can expect to receive the funds within a few days to a few weeks, depending on the lender.

Choosing the Right Business Loan for You

When considering business loans Michigan, it's essential to evaluate your business needs and financial situation. Ask yourself the following questions:

- What is the purpose of the loan?

- How much funding do I need?

- What is the best repayment term for my cash flow?

- What interest rates can I afford?

By answering these questions, you can narrow down your options and select the best financing solution for your business.

In conclusion, business loans Michigan provide a vital resource for entrepreneurs looking to grow and sustain their businesses. With various options available, understanding the types of loans, the application process, and how to choose the right one is crucial for success. By taking the time to research and prepare, you can unlock the financial resources needed to propel your business forward in Michigan's competitive landscape. Don't let funding challenges hold you back—explore your options today and take the first step towards achieving your business goals!