Unlock Your Dream Home with Cheap Mortgage Loans: Your Ultimate Guide to Affordable Financing Options

Finding the perfect home can be an exhilarating journey, but the financial aspect often feels daunting. Fortunately, there’s a silver lining: cheap mortgage……

Finding the perfect home can be an exhilarating journey, but the financial aspect often feels daunting. Fortunately, there’s a silver lining: cheap mortgage loans that can make your dream home a reality without breaking the bank. In this comprehensive guide, we’ll explore everything you need to know about cheap mortgage loans, including tips for securing the best rates, understanding the application process, and navigating the housing market.

#### Understanding Cheap Mortgage Loans

At its core, a mortgage is a loan specifically for purchasing real estate. When we talk about cheap mortgage loans, we refer to loans that come with lower interest rates and favorable terms, making homeownership more accessible. These loans can vary significantly based on factors such as your credit score, the loan amount, and the lender's policies.

#### Why Choose Cheap Mortgage Loans?

Opting for cheap mortgage loans offers numerous advantages. Firstly, lower interest rates can lead to significant savings over the life of the loan. For example, even a small reduction in your interest rate can save you thousands of dollars in interest payments. Additionally, affordable loans often come with flexible repayment terms, allowing you to choose a plan that fits your financial situation.

#### How to Find the Best Cheap Mortgage Loans

1. **Shop Around**: Don’t settle for the first offer you receive. Different lenders provide varying rates and terms, so it’s crucial to compare multiple options. Utilize online mortgage calculators to estimate your monthly payments and overall costs.

2. **Check Your Credit Score**: Your credit score plays a significant role in determining the interest rate you'll receive. Before applying for a mortgage, check your credit report for errors and take steps to improve your score if necessary.

3. **Consider Government Programs**: Various government programs offer cheap mortgage loans for first-time homebuyers and low-income families. Programs like FHA loans, VA loans, and USDA loans can provide more affordable options with lower down payments and reduced interest rates.

4. **Negotiate**: Don’t be afraid to negotiate with lenders. If you receive a better offer from another lender, use it as leverage to secure a more favorable rate.

#### The Application Process for Cheap Mortgage Loans

Once you’ve found a lender offering cheap mortgage loans, the application process typically involves several steps:

- **Pre-Approval**: Start by getting pre-approved for a loan. This involves submitting financial documents and allowing the lender to review your credit history. Pre-approval gives you a better idea of how much you can afford and strengthens your position when making an offer on a home.

- **Documentation**: Be prepared to provide documentation such as tax returns, pay stubs, and bank statements. Lenders require this information to assess your financial stability and ability to repay the loan.

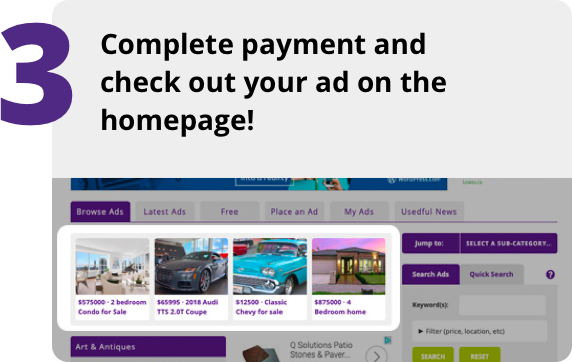

- **Closing**: After your application is approved, you’ll enter the closing phase. This involves signing the final paperwork and paying any closing costs. Once completed, you’ll receive the keys to your new home!

#### Conclusion: Step into Homeownership with Cheap Mortgage Loans

In conclusion, cheap mortgage loans are an excellent way to make homeownership achievable for many individuals and families. By understanding the options available, shopping around for the best rates, and preparing for the application process, you can secure an affordable mortgage that fits your needs. Don’t let financial concerns hold you back from your dream home; explore cheap mortgage loans today and take the first step towards a brighter future!