Bad Credit Installment Loans Ohio: Your Path to Financial Stability

Guide or Summary:What are Bad Credit Installment Loans?Why Choose Bad Credit Installment Loans Ohio?How to Apply for Bad Credit Installment Loans OhioWhat t……

Guide or Summary:

- What are Bad Credit Installment Loans?

- Why Choose Bad Credit Installment Loans Ohio?

- How to Apply for Bad Credit Installment Loans Ohio

- What to Expect When Using Bad Credit Installment Loans Ohio

In an economy where credit is the lifeblood of countless individuals and businesses, securing a loan can often seem like an insurmountable challenge, especially for those with less-than-perfect credit histories. This reality, however, doesn't have to be a barrier to achieving your financial goals. Enter bad credit installment loans Ohio: a beacon of hope for those in need of credit with a less-than-stellar credit score.

What are Bad Credit Installment Loans?

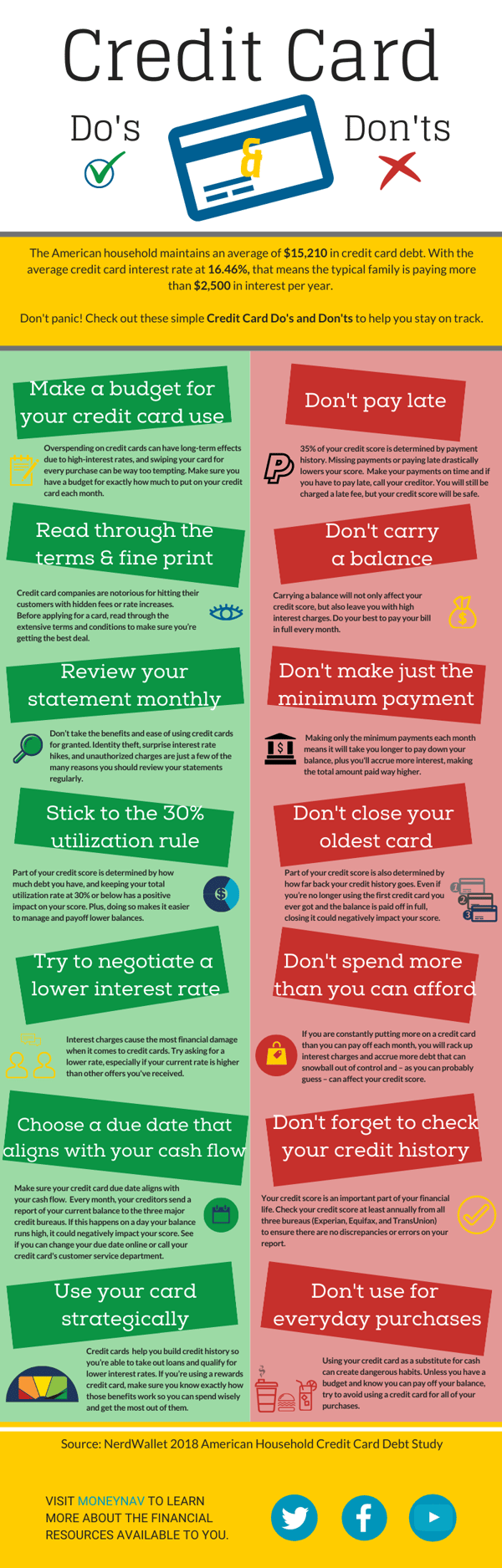

Before diving into the specifics of bad credit installment loans Ohio, it's essential to understand what they are. Essentially, these loans are designed for individuals with a lower credit score, providing them with the financial flexibility they need to meet their short-term or long-term financial obligations. Unlike traditional loans, installment loans are repaid over a set period, typically in monthly installments, making them an attractive option for those who need a steady cash flow.

Why Choose Bad Credit Installment Loans Ohio?

There are several compelling reasons to consider bad credit installment loans Ohio as your financial solution. Firstly, they offer a lifeline for those who might not qualify for traditional loans due to their credit history. Secondly, the repayment structure is designed to be manageable, reducing the risk of default and associated financial penalties. Lastly, the availability of these loans in Ohio means that you can access the funds you need without having to travel far or deal with lengthy application processes.

How to Apply for Bad Credit Installment Loans Ohio

The application process for bad credit installment loans Ohio is straightforward, designed to be accessible to a wide range of applicants. Typically, you'll need to provide some basic personal information, such as your name, address, and employment details. You'll also need to disclose your credit history, including any defaults or outstanding debts. Once your application is submitted, the lender will assess your creditworthiness and determine whether you qualify for the loan.

What to Expect When Using Bad Credit Installment Loans Ohio

When you receive approval for your bad credit installment loan, you'll be provided with the loan amount, interest rate, and repayment terms. It's crucial to read the terms and conditions carefully, as they will outline your obligations as a borrower. Typically, you'll have a set repayment period, during which you'll make regular monthly payments towards the loan. If you're unable to make a payment on time, you may incur additional fees or face the risk of default.

In conclusion, bad credit installment loans Ohio can be a valuable financial tool for those in need of credit. By offering manageable repayment terms and accessible lending options, these loans can help individuals and businesses overcome financial challenges and achieve their goals. If you're considering a bad credit installment loan in Ohio, it's essential to do your research and choose a reputable lender. With the right loan, you can take control of your finances and build a more stable financial future.