Understanding Your Financial Obligations: What You Need to Know About Student Loan Payments Due

#### Student Loan Payments DueNavigating the world of student loans can be overwhelming, especially when it comes to understanding when your student loan pa……

#### Student Loan Payments Due

Navigating the world of student loans can be overwhelming, especially when it comes to understanding when your student loan payments due are and how to manage them effectively. As graduation approaches, many students find themselves in a whirlwind of emotions—excitement for the future but anxiety about the financial responsibilities that lie ahead. This article aims to clarify what to expect regarding student loan payments due and how to prepare for them.

First and foremost, it's essential to know that student loan payments due typically begin six months after you graduate, leave school, or drop below half-time enrollment. This grace period is designed to give you some breathing room to find a job and stabilize your finances. However, it's crucial not to become complacent during this time. Start planning now to ensure you can meet your obligations when the time comes.

#### Types of Student Loans

Before diving into payment specifics, let's briefly discuss the different types of student loans you might have. Federal loans, which are funded by the government, often come with lower interest rates and more flexible repayment options. Private loans, on the other hand, are offered by banks or financial institutions and may have variable interest rates and less favorable repayment terms. Understanding the type of loans you have will help you know what to expect regarding your student loan payments due.

#### Repayment Plans

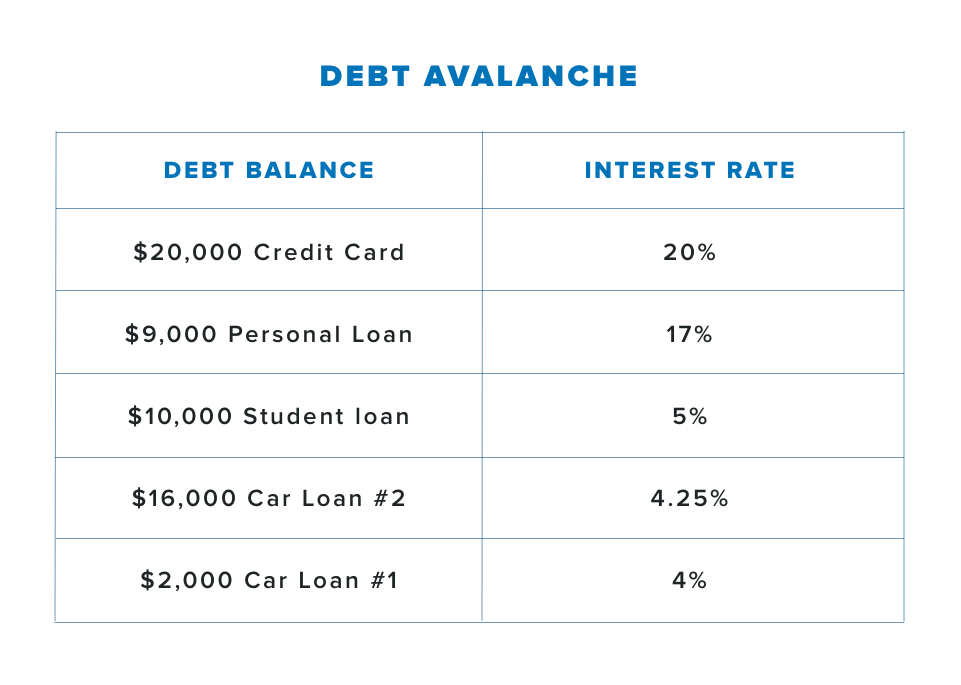

When your student loan payments due start, you'll have several repayment plan options to choose from. Standard repayment plans typically have fixed monthly payments over ten years, while graduated plans start with lower payments that increase over time. Income-driven repayment plans adjust your monthly payments based on your income, potentially making them more manageable.

It's advisable to review these options carefully and select the plan that best fits your financial situation. You can always change your repayment plan later if your circumstances change.

#### Budgeting for Student Loan Payments

Once you know when your student loan payments due are, the next step is to budget accordingly. Create a detailed monthly budget that includes your loan payments, living expenses, and any other financial obligations you may have. This budgeting process will help you avoid missing payments, which can lead to penalties and negative impacts on your credit score.

Additionally, consider setting aside a small emergency fund to cover unexpected expenses that may arise, ensuring that your loan payments remain a priority.

#### Staying Informed

Finally, staying informed about your loans is crucial. Regularly check your loan servicer's website for updates on your student loan payments due, interest rates, and any potential changes in repayment options. Attend any financial literacy workshops offered by your school or community to better understand managing your student loans.

In summary, understanding your student loan payments due is vital for your financial health after graduation. By knowing when your payments start, exploring repayment options, budgeting effectively, and staying informed, you can navigate this responsibility with confidence. Remember, you are not alone in this journey; many resources are available to help you manage your student loans successfully.