Unlock Fast Cash with Car Title Loans Indianapolis: Your Guide to Quick Financing Solutions

#### Introduction to Car Title Loans IndianapolisCar title loans Indianapolis are a popular financial solution for those in need of quick cash. These loans……

#### Introduction to Car Title Loans Indianapolis

Car title loans Indianapolis are a popular financial solution for those in need of quick cash. These loans allow borrowers to leverage the equity in their vehicles to secure funding, making it an attractive option for individuals facing unexpected expenses or financial emergencies.

#### What Are Car Title Loans?

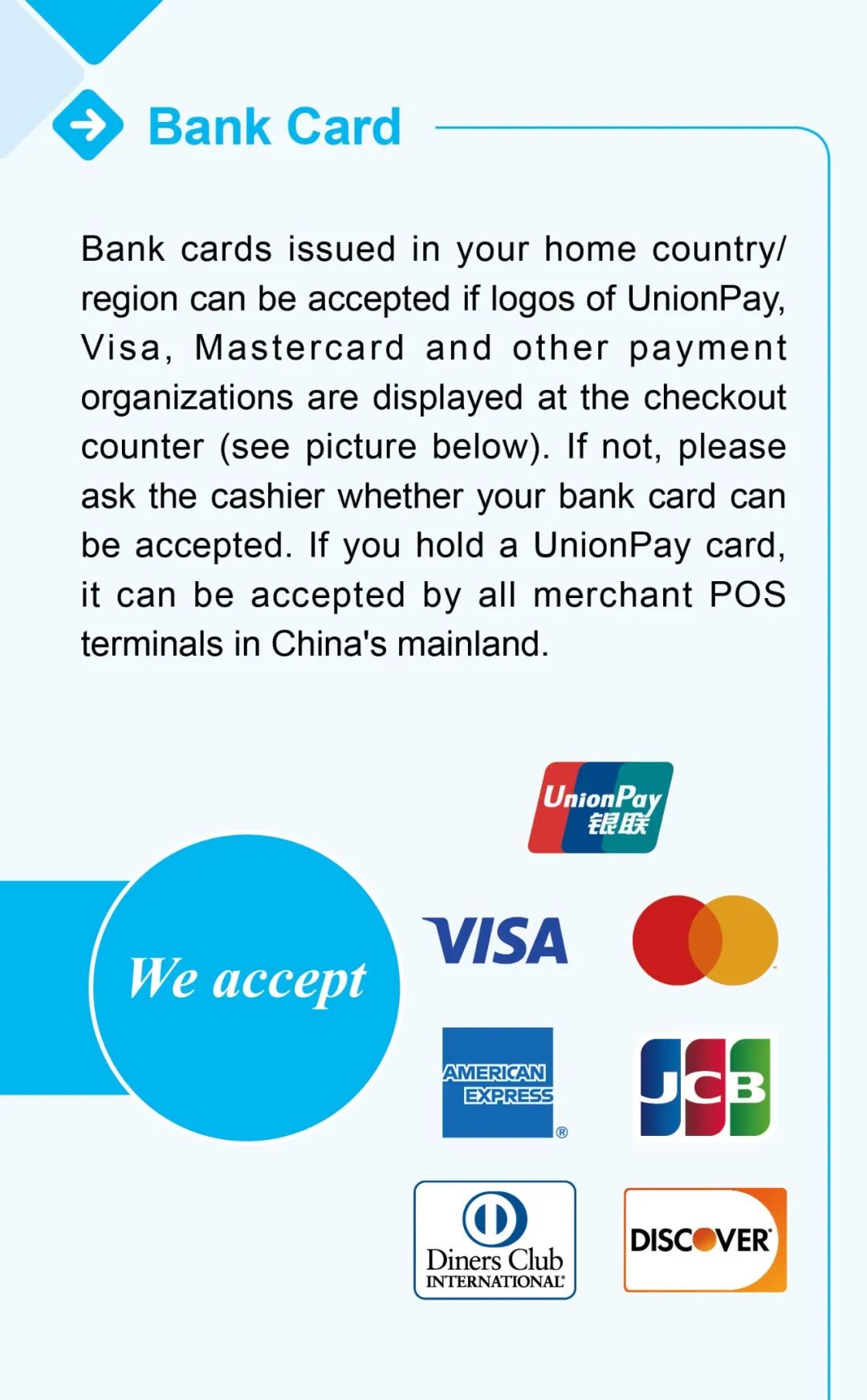

Car title loans are secured loans where the borrower uses their vehicle's title as collateral. This means that the lender holds the title until the loan is repaid. In Indianapolis, these loans are particularly appealing because they offer a fast and straightforward application process, often requiring minimal documentation and a quick approval time.

#### Benefits of Car Title Loans Indianapolis

One of the primary advantages of car title loans Indianapolis is the speed at which borrowers can access funds. Unlike traditional bank loans that may take days or weeks to process, car title loans can often be approved within hours. This quick turnaround is crucial for individuals who need money for urgent expenses, such as medical bills, car repairs, or unexpected home repairs.

Additionally, car title loans do not require a perfect credit score. Many lenders in Indianapolis are willing to work with borrowers who have less-than-ideal credit histories, making these loans accessible to a broader audience. As long as the vehicle has sufficient equity, borrowers can secure a loan regardless of their credit situation.

#### How to Apply for Car Title Loans Indianapolis

Applying for car title loans in Indianapolis is a straightforward process. Here are the steps typically involved:

1. **Gather Required Documents**: Borrowers need to provide the vehicle title, proof of identity, proof of income, and sometimes proof of residence. It's essential to ensure that the vehicle title is free of liens.

2. **Find a Reputable Lender**: Research lenders in Indianapolis that offer car title loans. Look for reviews and ratings to ensure you choose a trustworthy provider.

3. **Submit an Application**: Once you've selected a lender, you can fill out an application online or in-person. The lender will assess the vehicle's value and your financial situation.

4. **Receive Approval**: If approved, the lender will provide you with a loan offer. Review the terms and conditions carefully before accepting.

5. **Get Your Cash**: After signing the loan agreement, you will receive your funds, often on the same day.

#### Considerations Before Taking Out a Car Title Loan

While car title loans Indianapolis offer quick cash solutions, it's essential to consider the potential risks. The interest rates on these loans can be higher than traditional loans, and failing to repay the loan can result in the loss of your vehicle. Borrowers should ensure they have a solid repayment plan in place before committing to a loan.

#### Conclusion

Car title loans Indianapolis can be a lifeline for those in need of immediate financial assistance. With their quick approval process and accessibility, they provide a viable option for many individuals facing unexpected expenses. However, it is crucial to approach these loans with caution, understanding the terms and ensuring that repayment is feasible. By doing so, borrowers can unlock fast cash while keeping their vehicles secure.