A Comprehensive Guide on How to Find Interest Rate on Car Loan: Tips and Tools for Savvy Borrowers

#### How to find interest rate on car loanWhen it comes to financing a vehicle, understanding how to find the interest rate on a car loan is crucial for mak……

#### How to find interest rate on car loan

When it comes to financing a vehicle, understanding how to find the interest rate on a car loan is crucial for making informed financial decisions. The interest rate can significantly impact your monthly payments and the overall cost of the loan. This guide will walk you through the steps to find the best interest rate for your car loan, including tips on where to look, what factors influence rates, and tools you can use to compare offers.

#### Understanding Car Loan Interest Rates

Car loan interest rates can vary widely based on several factors, including your credit score, the loan term, and the lender's policies. Typically, borrowers with higher credit scores are offered lower interest rates because they are considered less risky. Conversely, those with lower credit scores may face higher rates, making it essential to know your credit standing before applying for a loan.

#### Steps to Find the Best Interest Rate

1. **Check Your Credit Score**: Before you start shopping for a car loan, check your credit score. You can obtain a free credit report from various online services. Knowing your score will help you understand what interest rates you might qualify for.

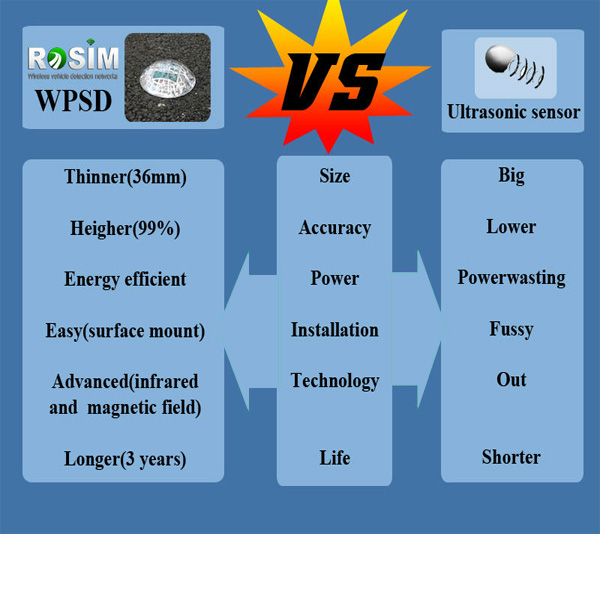

2. **Research Lenders**: Different lenders offer different rates, so it's important to shop around. Consider traditional banks, credit unions, and online lenders. Each may have different criteria for approval and varying rates.

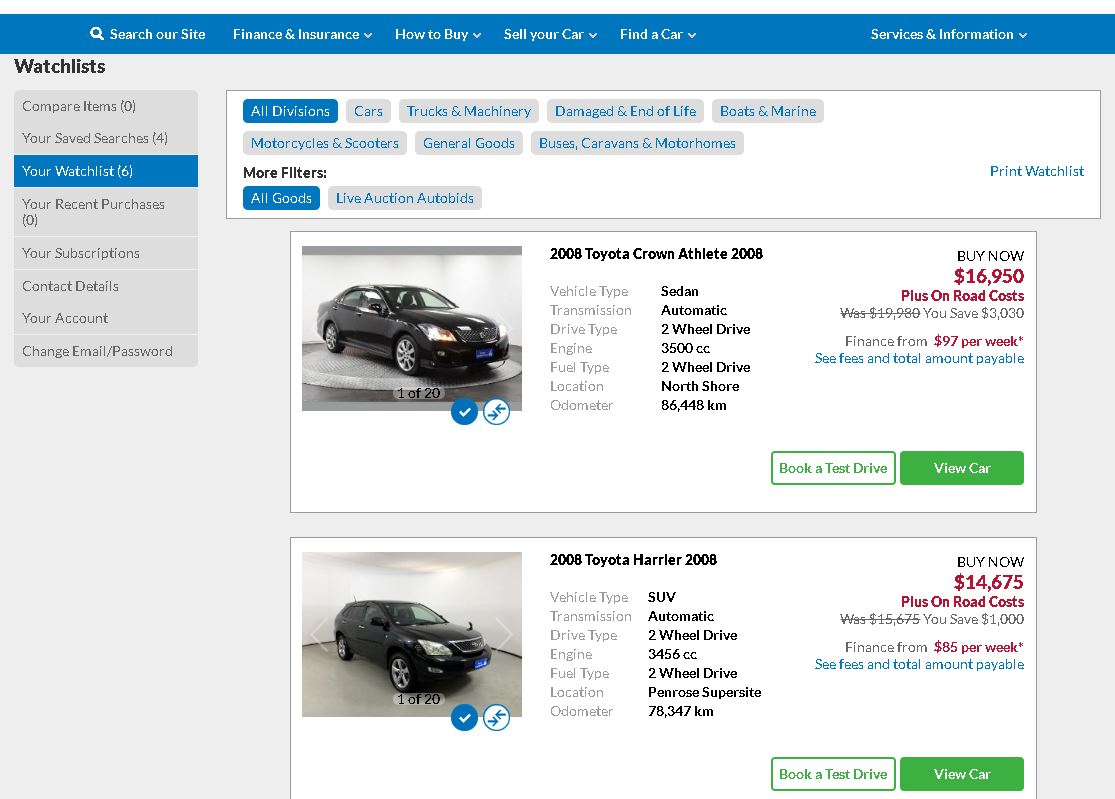

3. **Use Online Tools**: There are numerous online calculators and comparison tools that can help you estimate potential interest rates. Websites like Bankrate or NerdWallet allow you to input your information and receive personalized loan offers.

4. **Consider Loan Terms**: The length of the loan can also affect the interest rate. Generally, shorter loan terms come with lower interest rates, but they will result in higher monthly payments. Decide what works best for your budget.

5. **Get Pre-Approved**: Many lenders offer pre-approval, which gives you a better idea of the interest rate you can expect. This process involves a soft credit check and can help you understand your borrowing power.

6. **Negotiate**: Once you have a few offers, don't hesitate to negotiate. If you find a better rate elsewhere, let your preferred lender know. They may be willing to match or beat the offer to secure your business.

7. **Read the Fine Print**: Always review the terms and conditions of the loan before signing. Look for any hidden fees or penalties that could affect the overall cost of the loan.

#### Factors Influencing Interest Rates

- **Credit History**: Your payment history, credit utilization, and length of credit history all play a role in determining your credit score and, consequently, your interest rate.

- **Loan Amount**: The amount you borrow can also influence your rate. Larger loans may come with different rates than smaller ones.

- **Down Payment**: A larger down payment can lower your interest rate as it reduces the lender's risk.

- **Market Conditions**: Interest rates can fluctuate based on economic factors, so staying informed about current trends can help you time your loan application for the best rate.

#### Conclusion

Finding the best interest rate on a car loan requires research, preparation, and negotiation. By understanding your credit score, exploring various lenders, and using online tools, you can make an informed decision that saves you money in the long run. Remember to consider all factors that influence interest rates and always read the fine print before committing to a loan. With the right approach, you can secure a favorable rate that fits your financial situation.