Understanding the Average Age to Pay Off Student Loans: Key Factors and Strategies

#### Average Age to Pay Off Student LoansThe average age to pay off student loans has become a significant topic of discussion among recent graduates and fi……

#### Average Age to Pay Off Student Loans

The average age to pay off student loans has become a significant topic of discussion among recent graduates and financial experts alike. As student debt continues to rise, understanding the timeline for repayment is essential for anyone considering higher education. This article will explore the average age to pay off student loans, the factors influencing this timeline, and effective strategies to manage and reduce debt.

#### Factors Influencing the Average Age to Pay Off Student Loans

Several factors contribute to the average age at which individuals can successfully pay off their student loans. These factors include:

1. **Type of Degree**: The level of education attained plays a crucial role in determining the average age to pay off student loans. Typically, individuals with advanced degrees may find themselves in higher-paying positions, allowing them to pay off their loans more quickly. Conversely, those with only an undergraduate degree may face a longer repayment period, especially if they enter lower-paying fields.

2. **Loan Amount**: The total amount of student debt incurred is another significant factor. Graduates with larger loans often take longer to pay them off, particularly if their starting salaries do not align with their debt levels. Understanding the average age to pay off student loans in relation to the amount borrowed can help individuals set realistic repayment goals.

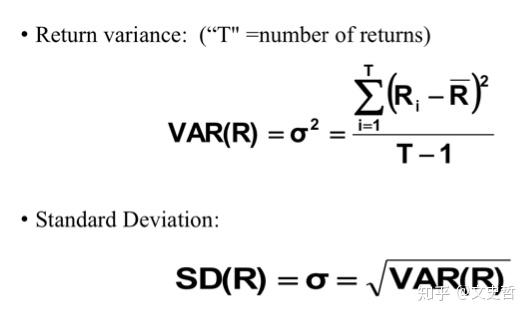

3. **Interest Rates**: The interest rates on student loans can significantly impact repayment timelines. Higher interest rates can lead to increased monthly payments, extending the duration of debt. Conversely, individuals with lower interest rates may find it easier to pay off their loans sooner, thus affecting the average age to pay off student loans.

4. **Employment Opportunities**: The job market plays a vital role in determining how quickly individuals can pay off their student loans. Graduates who secure well-paying jobs shortly after graduation are more likely to pay off their loans faster. In contrast, those who struggle to find employment or settle for lower-paying jobs may face longer repayment periods.

5. **Repayment Plans**: The choice of repayment plans can also influence the average age to pay off student loans. Graduates can choose from various repayment options, including standard, income-driven, and extended repayment plans. Each option has its implications on the duration of the loan, and understanding these can help borrowers make informed decisions.

#### Strategies to Manage and Reduce Student Loan Debt

To achieve a timely repayment of student loans and potentially lower the average age to pay off student loans, individuals can adopt several effective strategies:

1. **Create a Budget**: Developing a comprehensive budget that accounts for monthly loan payments, living expenses, and savings can help individuals manage their finances better. By prioritizing loan payments, borrowers can accelerate their repayment journey.

2. **Make Extra Payments**: Whenever possible, making extra payments towards the principal balance can significantly reduce the overall interest paid and shorten the repayment period. Even small additional payments can make a substantial difference over time.

3. **Explore Loan Forgiveness Programs**: Various federal and state loan forgiveness programs are available for individuals working in specific fields, such as public service or education. Researching and applying for these programs can relieve some financial burdens and reduce the average age to pay off student loans.

4. **Refinance Loans**: For those with good credit scores, refinancing student loans can lead to lower interest rates and more manageable monthly payments. This option can potentially shorten the repayment period and decrease the overall cost of the loan.

5. **Stay Informed**: Keeping up with changes in student loan policies, interest rates, and repayment options is crucial. Being informed allows individuals to make strategic decisions regarding their loans and repayment plans.

In conclusion, understanding the average age to pay off student loans is essential for anyone navigating the complexities of student debt. By considering the various factors that influence repayment timelines and implementing effective strategies, borrowers can work towards a financially stable future and potentially reduce the time it takes to pay off their loans.