Is Experian Loans Legit? A Comprehensive Guide to Understanding Experian's Loan Services

#### IntroductionWhen it comes to borrowing money, trust is a crucial factor. Many consumers often ask, "Is Experian Loans legit?" This question arises as i……

#### Introduction

When it comes to borrowing money, trust is a crucial factor. Many consumers often ask, "Is Experian Loans legit?" This question arises as individuals seek reliable financial solutions. Experian, primarily known as a credit reporting agency, has expanded its services to include loan offerings. In this article, we will explore the legitimacy of Experian Loans, its features, and what you need to know before considering it as an option.

#### What is Experian Loans?

Experian Loans is a service that connects borrowers with various lenders, allowing users to compare loan offers based on their credit profiles. Unlike traditional banks, Experian does not directly lend money; instead, it acts as a facilitator, helping consumers find suitable loan options that meet their financial needs.

#### How Does Experian Loans Work?

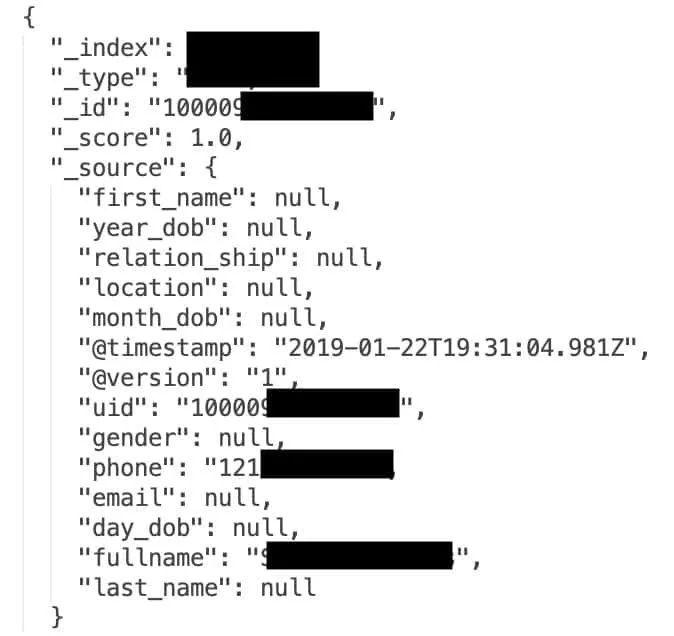

To utilize Experian Loans, users typically need to create an account and provide some personal information, including income, credit score, and loan amount desired. The platform then matches users with potential lenders, displaying a range of loan products. This process is designed to be transparent and user-friendly, making it easier for borrowers to make informed decisions.

#### Is Experian Loans Legit? Key Factors to Consider

1. **Reputation**: Experian is one of the largest credit bureaus in the world, with a long-standing reputation in the financial industry. This credibility lends weight to the legitimacy of its loan services.

2. **Consumer Protection**: Experian adheres to strict regulations and guidelines to protect consumer data. This commitment to privacy and security is essential for any financial service.

3. **User Reviews**: Checking online reviews and testimonials can provide insight into the experiences of other borrowers. While individual experiences may vary, a general trend can often be observed.

4. **Loan Terms**: Understanding the terms and conditions of any loan is vital. Experian Loans provides clear information about interest rates, fees, and repayment schedules, allowing borrowers to make informed choices.

5. **Customer Support**: A legitimate service typically offers robust customer support. Experian provides various channels for assistance, ensuring that users can get help when needed.

#### Pros and Cons of Using Experian Loans

**Pros**:

- **Convenience**: The platform allows users to compare multiple loan options in one place.

- **Tailored Offers**: Users receive personalized loan offers based on their credit profiles.

- **Educational Resources**: Experian provides resources to help users understand loans and credit.

**Cons**:

- **Limited Direct Lending**: Since Experian does not lend directly, users may still need to navigate the lending process with third parties.

- **Variable Loan Terms**: Depending on the lender, terms and rates can vary significantly.

#### Conclusion

So, is Experian Loans legit? Based on its reputation, consumer protection measures, and user experiences, it appears to be a legitimate option for those seeking loans. However, as with any financial decision, it's crucial to conduct thorough research and consider your individual circumstances before proceeding. By understanding the ins and outs of Experian Loans, you can make an informed choice that aligns with your financial goals.

Remember, borrowing money is a significant commitment, and assessing all available options is essential for ensuring a positive financial future.