Understanding How Often Can You Refinance Home Loan: A Comprehensive Guide

#### How Often Can You Refinance Home LoanRefinancing a home loan can be a strategic financial move, but many homeowners wonder, **how often can you refinan……

#### How Often Can You Refinance Home Loan

Refinancing a home loan can be a strategic financial move, but many homeowners wonder, **how often can you refinance home loan**? This question is crucial for anyone looking to lower their monthly payments, change their loan term, or tap into equity. In this article, we will explore the ins and outs of refinancing, including the frequency, benefits, and potential pitfalls.

#### The Basics of Refinancing

Refinancing involves replacing your existing mortgage with a new one, usually with better terms. Homeowners often choose to refinance to achieve a lower interest rate, reduce monthly payments, or switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage. The decision to refinance should be based on a careful evaluation of your financial situation and long-term goals.

#### How Often Can You Refinance Home Loan?

The general guideline is that homeowners can refinance as often as they want, provided they meet the lender's requirements. However, there are several factors to consider:

1. **Lender Policies**: Different lenders have varying policies regarding refinancing. Some may impose a waiting period before allowing a second refinance, while others may not. It's essential to check with your lender to understand their specific rules.

2. **Loan Type**: The type of loan you have can also influence how often you can refinance. For instance, government-backed loans like FHA or VA loans may have specific guidelines about refinancing.

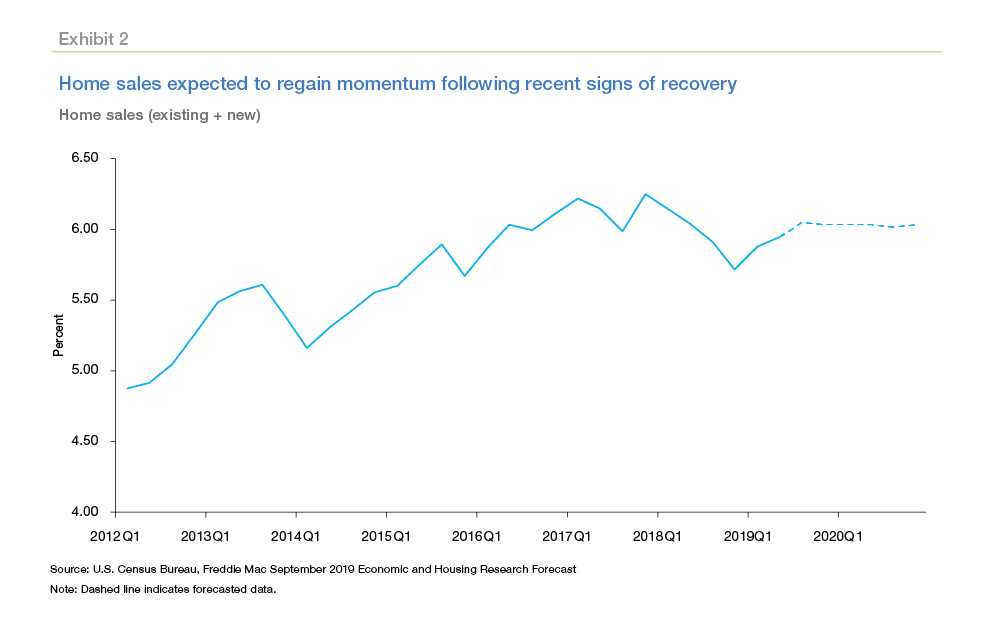

3. **Market Conditions**: The state of the housing market can impact your decision to refinance. If interest rates are falling, it might make sense to refinance sooner rather than later. Conversely, if rates are rising, waiting might be a better strategy.

4. **Costs of Refinancing**: Refinancing isn't free; it comes with closing costs that can range from 2% to 5% of the loan amount. If you refinance too often, these costs can outweigh the benefits. It's crucial to calculate the break-even point to determine if refinancing is financially viable.

5. **Credit Score**: Your credit score can affect your ability to refinance. Lenders typically prefer borrowers with a credit score of 620 or higher. If your credit score has improved since your last refinance, you may qualify for better rates.

#### Benefits of Refinancing

- **Lower Monthly Payments**: One of the most significant advantages of refinancing is the potential to lower your monthly payments, which can free up cash for other expenses or savings.

- **Access to Equity**: If your home has appreciated in value, refinancing can allow you to access that equity for home improvements, debt consolidation, or other financial needs.

- **Shorter Loan Term**: Refinancing to a shorter loan term can save you money on interest over the life of the loan, even if your monthly payments are higher.

#### Potential Pitfalls

While refinancing can offer many benefits, there are potential downsides to consider:

- **Closing Costs**: As mentioned earlier, the costs associated with refinancing can add up. It's essential to weigh these costs against the potential savings.

- **Longer Loan Terms**: If you refinance to a new 30-year mortgage, you may end up paying more in interest over the life of the loan, even if your monthly payments are lower.

- **Impact on Credit Score**: Applying for a new loan can temporarily lower your credit score, which may affect your ability to secure favorable rates.

#### Conclusion

In summary, the question of **how often can you refinance home loan** is multifaceted. While there are no strict limits on the frequency of refinancing, it's essential to consider lender policies, market conditions, and the associated costs. By carefully evaluating your financial situation and understanding the benefits and potential pitfalls, you can make an informed decision about whether and when to refinance your home loan. Always consult with a financial advisor or mortgage professional to ensure that refinancing aligns with your long-term financial goals.