Understanding Down Payment for Construction Loan: Key Factors and Tips to Secure Your Financing

#### What is a Down Payment for Construction Loan?A down payment for a construction loan refers to the initial amount of money that a borrower must pay upfr……

#### What is a Down Payment for Construction Loan?

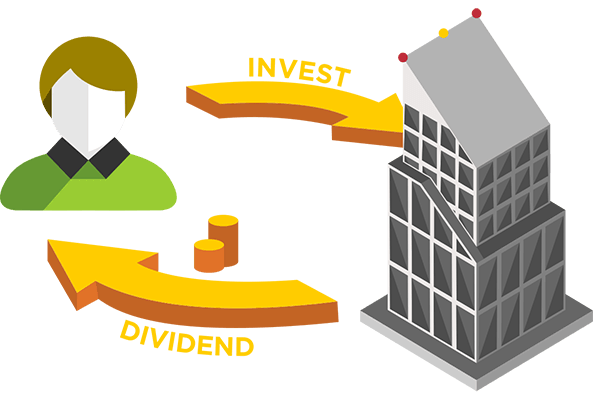

A down payment for a construction loan refers to the initial amount of money that a borrower must pay upfront when securing financing to build a new home or property. This payment is typically expressed as a percentage of the total construction cost and is a crucial part of the loan approval process. Lenders require a down payment as a way to mitigate their risk, ensuring that the borrower has a vested interest in the project.

#### Importance of Down Payment for Construction Loan

The down payment for a construction loan serves several important functions. Firstly, it demonstrates the borrower’s commitment and financial stability to the lender. A substantial down payment can improve the chances of loan approval, as it indicates that the borrower is less likely to default on the loan. Additionally, a larger down payment may lead to better loan terms, such as lower interest rates or reduced monthly payments.

#### Typical Down Payment Requirements

The down payment requirements for construction loans can vary significantly based on the lender, the borrower’s creditworthiness, and the overall project cost. Generally, borrowers can expect to pay anywhere from 10% to 20% of the total construction budget as a down payment. However, some lenders may offer programs that allow for lower down payments, especially for first-time homebuyers or those with excellent credit.

#### Factors Influencing Down Payment Amount

Several factors can influence the required down payment for a construction loan. These include:

1. **Credit Score**: Borrowers with higher credit scores are often seen as lower risk, which may result in lower down payment requirements.

2. **Loan Type**: Different types of construction loans, such as FHA or VA loans, may have specific down payment guidelines that differ from conventional loans.

3. **Project Scope**: The size and complexity of the construction project can also affect the down payment. Larger projects may require a higher down payment to secure financing.

#### Strategies to Save for a Down Payment

Saving for a down payment for a construction loan can be a daunting task, but there are several strategies that can help prospective borrowers accumulate the necessary funds:

1. **Create a Budget**: Establishing a detailed budget can help identify areas where expenses can be reduced, allowing for more savings each month.

2. **Set Up a Dedicated Savings Account**: Having a separate account for your down payment can help you stay focused on your goal and track your progress.

3. **Explore Assistance Programs**: Many local and state governments offer down payment assistance programs for first-time homebuyers, which can provide valuable financial support.

#### Conclusion

In summary, understanding the down payment for a construction loan is essential for anyone looking to build their dream home. By being aware of the requirements, factors influencing the down payment amount, and strategies to save, borrowers can better prepare themselves for the construction loan process. Taking the time to research and plan can lead to a smoother financing experience and ultimately help you achieve your construction goals.