Understanding FHA Loan Closing Costs: A Comprehensive Guide for Homebuyers

#### What are FHA Loan Closing Costs?FHA loan closing costs refer to the fees and expenses associated with finalizing a mortgage through the Federal Housing……

#### What are FHA Loan Closing Costs?

FHA loan closing costs refer to the fees and expenses associated with finalizing a mortgage through the Federal Housing Administration (FHA). These costs can include a variety of charges such as loan origination fees, appraisal fees, title insurance, and more. Understanding these costs is crucial for prospective homebuyers as they can significantly impact the overall affordability of purchasing a home.

#### Components of FHA Loan Closing Costs

The closing costs for FHA loans typically range from 2% to 5% of the loan amount. Here are some of the main components that contribute to these costs:

1. **Loan Origination Fee**: This is a fee charged by the lender for processing the loan application. It usually ranges from 0.5% to 1% of the loan amount.

2. **Appraisal Fee**: Before approving the loan, lenders require an appraisal to determine the property's market value. This fee can vary but generally falls between $300 and $500.

3. **Title Insurance**: This protects the lender against any claims on the property. The cost of title insurance can vary widely depending on the location and value of the property.

4. **Prepaid Taxes and Insurance**: Homebuyers may need to pay a portion of property taxes and homeowners insurance upfront at closing.

5. **Credit Report Fee**: Lenders will pull your credit report to assess your creditworthiness, which incurs a fee.

6. **Recording Fees**: These are fees charged by the local government to record the new mortgage and change the ownership of the property.

7. **Escrow Fees**: If using an escrow service to manage the closing process, there may be additional fees involved.

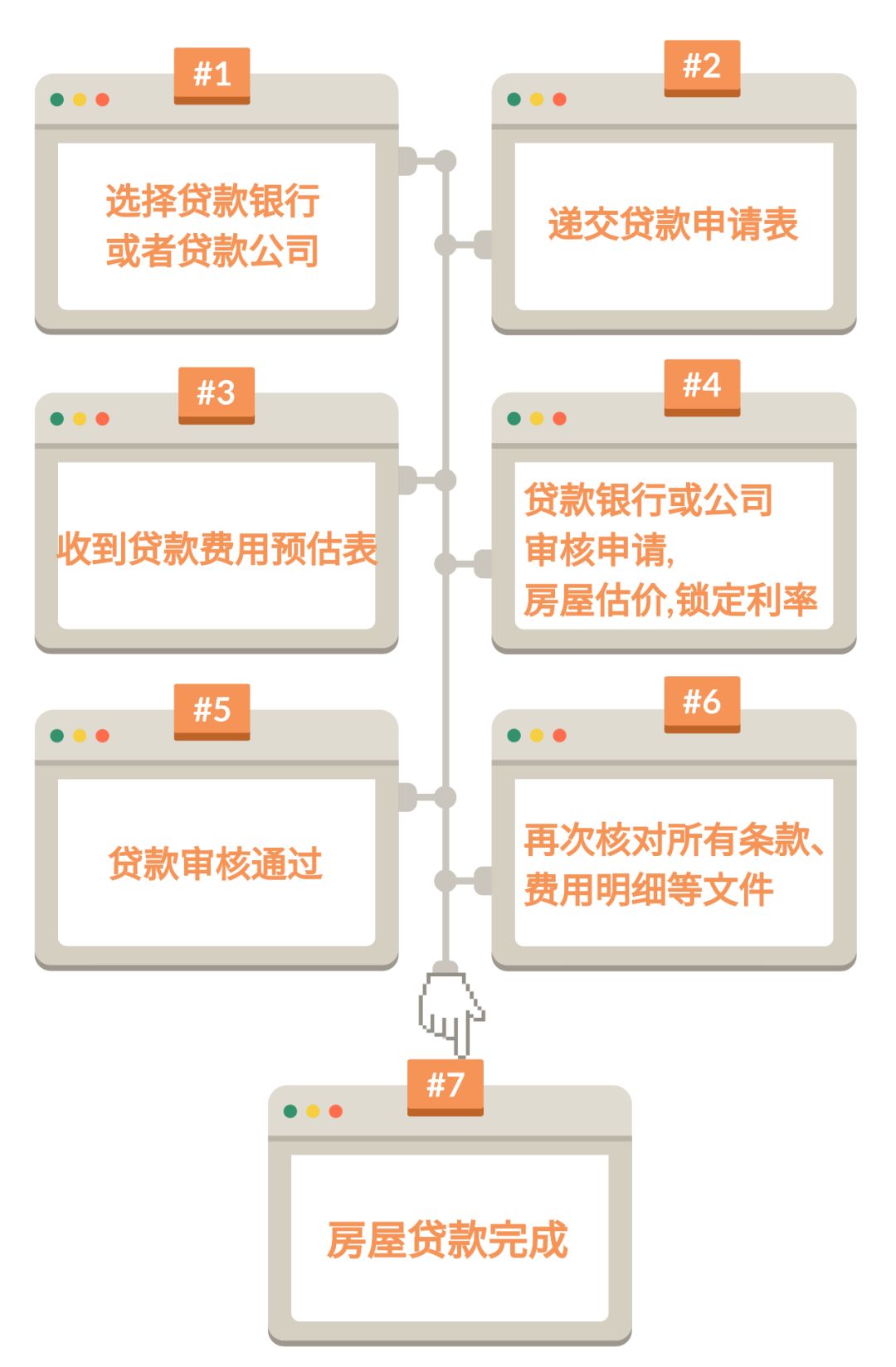

#### How to Estimate FHA Loan Closing Costs

Estimating FHA loan closing costs can be done through a few methods. One of the most effective ways is to request a Loan Estimate from your lender. This document outlines the expected closing costs and provides transparency in the loan process. Additionally, using online calculators can give you a rough idea of what to expect based on your loan amount and location.

#### Ways to Reduce FHA Loan Closing Costs

While closing costs can be significant, there are several strategies homebuyers can employ to minimize these expenses:

1. **Shop Around**: Different lenders may offer varying fees for the same services. Comparing multiple lenders can help you find the best deal.

2. **Negotiate Fees**: Don’t hesitate to negotiate certain fees with your lender. Some costs may be flexible, and lenders may be willing to lower them to secure your business.

3. **Ask for Seller Concessions**: In some cases, sellers may agree to cover a portion of the closing costs as part of the negotiation process.

4. **Consider a No-Closing-Cost Loan**: Some lenders offer loans that come with no closing costs, but be aware that these loans may have higher interest rates.

#### Conclusion

Understanding FHA loan closing costs is essential for any homebuyer looking to finance a property through this government-backed program. By being informed about the various components of closing costs, how to estimate them, and strategies to reduce them, buyers can navigate the home buying process more effectively. Always remember to ask questions and seek clarification from your lender to ensure you are fully aware of all costs involved before closing on your new home.